Aligning Business Goals with Global Sustainability: JP Morgan’s Role in the UN’s Development Agenda

In recent years, there has been growing concern over the impact of business and finance on the environment and society. As a result, many companies are now looking to align their corporate strategies with the United Nations Sustainable Development Goals (SDGs). One company that has taken a leading role in this area is JP Morgan. In this blog post, I will give a brief background on what are the UNs SDGs and explore the ways in which JP Morgan is contributing to the SDGs and the impact that its efforts are having on the world.

What are the United Nations SDGs

On the 1st of January 2016, the United Nations Sustainable Development Goals, which were adopted by world leaders in September 2015, officially came into force by the UN’s 193 member states. The 2030 Agenda for Sustainable Development consists of 17 goals which apply to developed and developing countries that address economic, environmental and social issues. These goals recognise that ending poverty and other deprivations go hand in hand with strategies that improve health and education, reduce inequality and spur economic growth, whilst addressing climate change

1) No poverty

The first goal of the SDGs adopted by the UN is to end poverty in all its forms and dimensions, everywhere in the world. The World Bank currently records people living in extreme poverty as surviving on less than $1.90 a day, 9.2% of people globally. The Covid-19 pandemic drove an additional 97 million people into extreme poverty in 2020, reversing years of progress against global poverty and income inequalities

2) Decent Work and Economic Growth

Goal 8 of the SDGs is to promote inclusive and sustainable economic growth, employment and decent work for all. The goal aims to create more jobs, boost economic productivity and encourage entrepreneurship while ensuring that people work under safe and fair conditions with social protections. The UN set the goal of at least 7% gross domestic product growth per annum in the least developed countries

3) Industry, Innovation and Infrastructure

Goal 9 of the SDGs is to build resilient infrastructure, promote inclusive and sustainable industrialization and foster innovation. By investing in sustainable and inclusive industries, promoting technological innovation and increasing access to essential infrastructure, can promote economic growth, reduce poverty and achieve sustainable development. With over half the world now living in cities, mass transport and renewable energy are becoming ever more important, as are the growth of new industries and information and communication technologies

4) Climate Action

Goal 13 is a key goal of the UN’s 2030 Agenda as climate change affects every country worldwide. Its aim is to combat climate change and its impact by promoting actions to reduce greenhouse gas emissions and increase resilience and adaptation to the changing climate. Several targets are in place to achieve this goal, such as strengthening the ability of countries to deal with the impacts of climate change, promoting education and awareness on climate change mitigation and adaption and increasing investment on climate change. To meet these targets a lot more needs to be done, collective action from governments, businesses, civil society and individuals is required to transition to a low-carbon and climate-resilient economy. Climate change is disrupting national economies and effecting lives, costing people, communities and countries dearly everyday

JP Morgan’s Sustainable Development Contribution

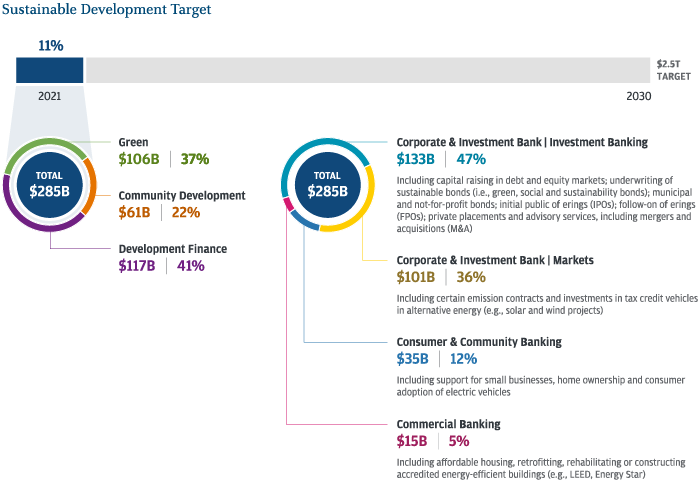

JP Morgan Chase has set a target to finance $2.5 trillion from 2021 through to the end of 2030 to advance long-term solutions that address climate change and contribute to sustainable development. JP Morgan has taken a firm stance on the matter stating that “environmental, social and governance (ESG) considerations are integrated into the policies and principles that govern and reflect our commitment to inclusive, sustainable growth”,

Development Finance is used to leverage sources of finance and expertise to support the quality of life in developing countries. JP Morgan’s Development Finance Institution (JPM FI) aims to mobilise capital in order to promote the UNs SDGs in developing nations, ensuring all development finance transactions align with the firms Environmental and Social Policy

In developed markets, JP Morgan is focusing on advancing economic inclusion through community development initiatives. Stating on their website that through community development banking they are “tackling the affordable housing crisis, one community at a time”

Overall, JP Morgan’s contributions to these issues have helped to drive economic growth, reduce poverty and improve the quality of life for individuals and communities around the world. By demonstrating a commitment to social responsibility and community development, they are encouraging other banks to also engage in activities that benefit society. JP Morgan’s leadership in financing large-scale development projects and addressing societal issues can serve as a model for other banks to follow. As other banks begin to adopt similar practices, we can expect to see a shift towards a more socially responsible and sustainable banking industry, benefiting both the economy and society.

Works Cited

Chase, J. M., 2023. Community Development Banking. [Online]

Available at: https://www.jpmorgan.com/commercial-banking/solutions/commercial-real-estate/community-development-banking

Co, J. M. C. &., 2021. Our Approach to Our Sustainable Development Target, s.l.: s.n.

Morgan, J., 2022. Sustainability, Our Commitments. [Online]

Available at: https://www.jpmorganchase.com/impact/sustainability/es-commitments#sustainabledevelopment

Morgan, J., 2023. Who we are. [Online]

Available at: https://www.jpmorganchase.com/about/governance/esg

SDG, 2022. Joint SDG Fund. [Online]

Available at: https://jointsdgfund.org/sustainable-development-goals/goal-9-industry-innovation-infrastructure

UN, 2023. Goal 8. [Online]

Available at: https://sdgs.un.org/goals/goal8

UN, 2023. Sustainable Development Goal 13: Climate Action. [Online]

Available at: https://www.unoosa.org/oosa/en/ourwork/space4sdgs/sdg13.html

UN, 2023. The 17 Goals. [Online]

Available at: https://sdgs.un.org/goals

Vision, W., 2022. Global poverty. [Online]

Available at: https://www.worldvision.org/sponsorship-news-stories/global-poverty-facts

ESG investment is rapidly gaining momentum, and this article brilliantly explores its benefits. From aligning values to generating sustainable returns, it showcases the power of responsible investing. A thought-provoking read for those seeking to make a positive impact while achieving financial goals.

ReplyDelete